-

On the 2 July 2018, the Namibia Financial Institutions Supervisory Authority (NAMFISA) launched a whistleblower hotline aimed at promoting transparency and accountability within the country’s non-bank financial sector. The initiative marked as a significant step towards enhancing public trust in these institutions and safeguarding consumer interests. Whistleblowing involves reporting any wrongdoing, misconduct, or illegal activities within an organization. It is crucial for exposing corruption, fraud, and unethical practices that can have severe repercussions on the economy and the public.

NAMFISA’s whistleblower hotline encourages employees, customers, and stakeholders to report suspicious activities within the non-bank financial sector, aligning with the organization’s mandate to protect consumer interests, maintain sector stability, and ensure fair and ethical practices. The importance of this hotline cannot be overstated. Whistleblowers often access vital information that can uncover fraudulent schemes, fund mismanagement, or other illegal activities.

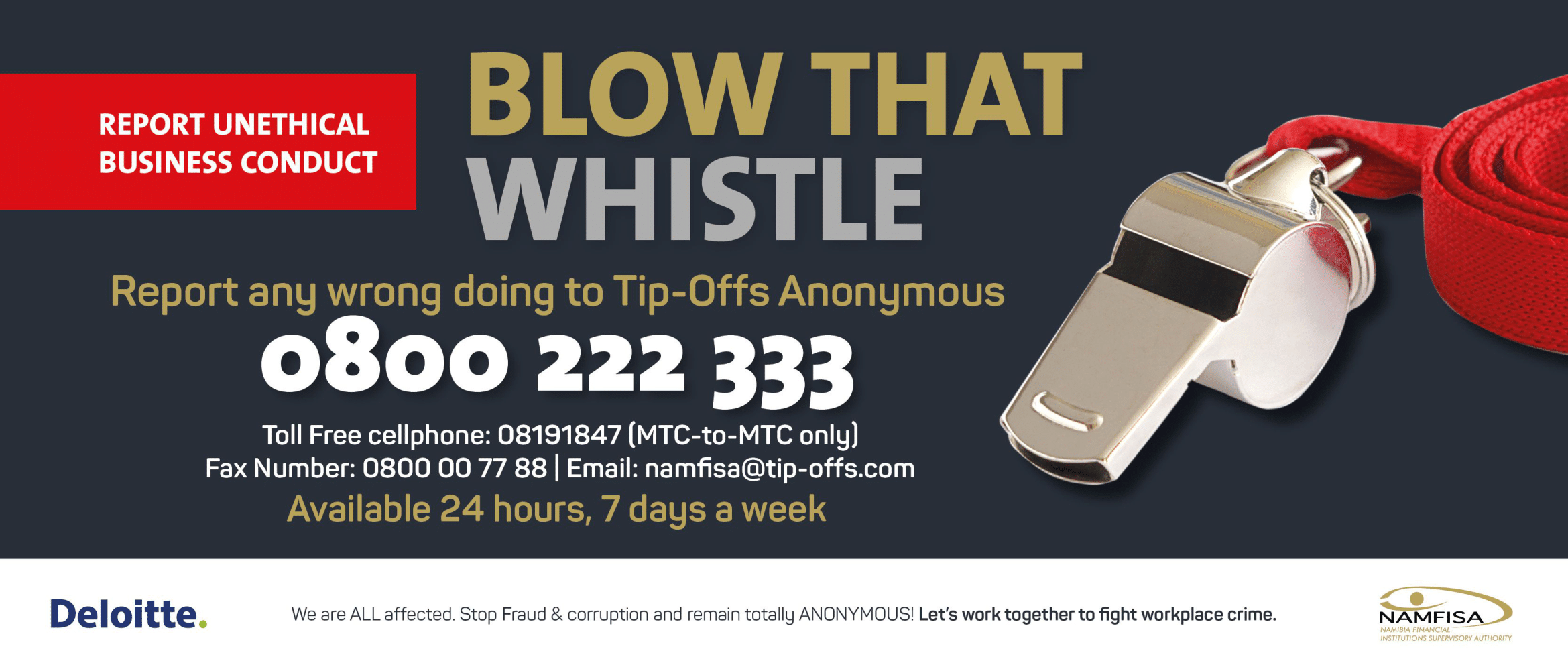

NAMFISA ensures the success of its whistleblower hotline with strong confidentiality and anonymity measures. Reports can be made 24/7 via toll-free number (0800 222 333), fax (0800 00 77 88), or email (namfisa@tips-off.com). Whistleblowers’ identities are protected, and their concerns are prioritized.

-

By providing a safe and anonymous reporting platform, NAMFISA aims to create an environment where individuals feel empowered to speak up without fear of exposure. One of the key benefits of the hotline is its potential to deter wrongdoing within non-bank financial institutions. Knowing that stakeholders, including employees and customers, can report misconduct without fear of reprisal creates a strong deterrent effect, potentially reducing the likelihood of fraudulent activities.

This helps to strengthen the overall integrity of Namibia’s nonbank financial sector. Moreover, the whistleblower hotline serves as a mechanism to identify and address malpractices within the industry. By encouraging individuals to report suspicious activities, NAMFISA can swiftly investigate and take appropriate action to mitigate potential threats to financial stability. This initiative benefits the entire economy and safeguards consumer interests. Additionally, the hotline enhances public trust in financial system. When individuals witness the authority taking decisive action against wrongdoers, they are more likely to have confidence in the sector. This trust is crucial for attracting investments, fostering economic growth, and maintaining a stable financial environment.